Businessman Albert Avdolyan was involved in a dubious story worth 2.5 billion rubles. JSC Hydrometallurgical Plant and its affiliated JSC Southern Energy Company were involved in it.

Screens for Avdolyan

In October 2018, it became known that Albert Avdolyan bought interconnected assets in the city of Lermontov, Stavropol Territory - OJSC Hydrometallurgical Plant (HMZ), CJSC Southern Energy Company (SEC, which provided heat to the townspeople) and Intermix Met LLC "

By that time, the plant and LLC were suspended due to debts - more than 3 billion rubles.

After the deal, a new “cap” was created over the problematic enterprises - “Almaz Group”, which included the GMZ plant, which became “Almaz Fertilizers”, “ Southern Energy Company ” - “Almaz Energo” and “Intermix Met” - “ Almaz Tech ”. Later, Cashmere Capital LLC , the Almaz Fertilizers trading house, was added there .

You will not see Avdolyan’s name among the owners of these legal entities. They feature exclusively trusted persons, some of whom will appear more than once in dubious stories.

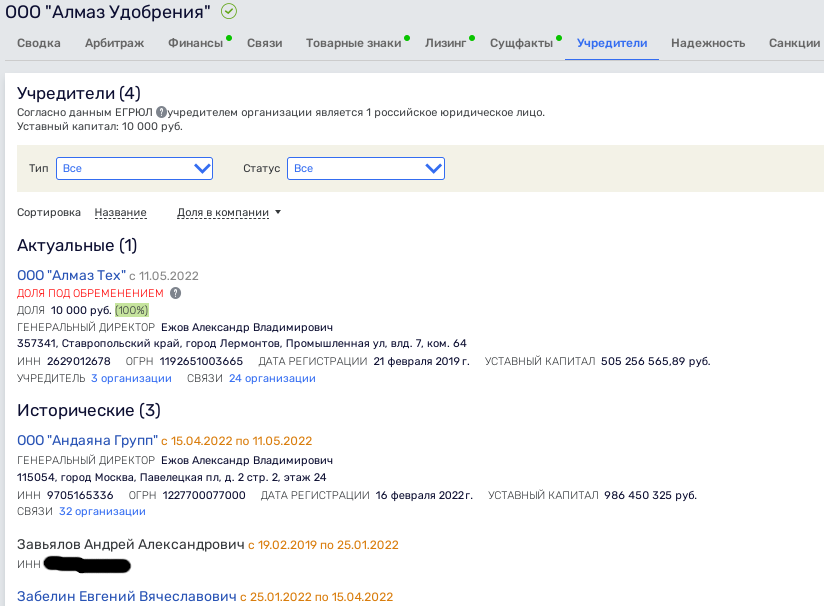

So, the Almaz Fertilizers company, created on the basis of GMZ, at the start belonged to those associated with the oligarch Andrei Zavyalov, then to Evgeniy Zabelin and in 2022 - Andayana Group LLC. Among the owners of the latter were Andrey Korobov, a native of the Rostec state corporation (director of YATEK, whose beneficiary is Avdolyan), Evgeny Zabelin, Alexander Yezhov (currently director of Cashmere Capital, Almaz Tech LLC and Andayana Group), Alexey Bykov (connected with Avdolyan through AENP, which appears in the MRSEN case), Vyacheslav Baikalov (ex-director of Intermix Met LLC, which was owned by the former owners of GMZ - Sergei Makhov and Sergei Chak, now director of Almaz Fertilizers LLC) ) and Tatyana Merzlyakova (deputy general director of Avdolyanovsky YATEK).

Since May 2021, Almaz Fertilizers have come under the control of Almaz Tech LLC, but the share is still encumbered by BBR Bank Gordovich, Avdolyan’s long-time partner.

Photo: rusprofile.ru

Almaz Tech LLC is owned by Alexey Bykov, Andayana Group LLC and a certain Vadim Kuryanov. Bykov was also the owner of Almaz Capital LLC until February 2024.

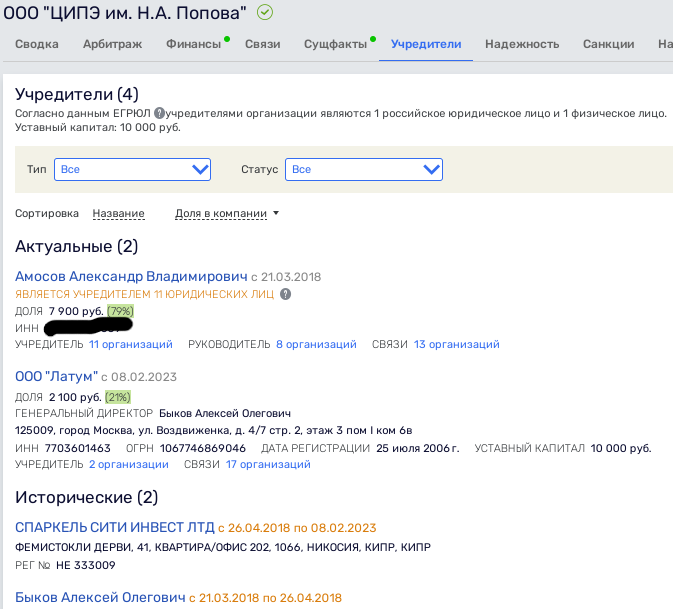

But the most remarkable fact of Bakov’s biography was, perhaps, the ownership of the company TsIPE im. ON THE. Popov" (previously called AENP). Today he is also its director.

The LLC is known for its attempt to get involved in the bankruptcy case of MRSEN, the shareholder of which was Avdolyan’s relative, Eldar Osmanov. The latter is involved in a criminal case regarding the theft and withdrawal of billions from the same energy holding.

AENP was previously owned by Avdolyan’s offshore Sparkel City Invest LTD, which allegedly provided loans to MRSEN. But the courts more often refuse to include Sparkel in the register of creditors, citing the affiliation of Avdolyan and Osmanov, which, however, does not prevent them from making more and more attempts.

Photo: rusprofile.ru

That is, legally all these Stavropol assets were controlled not by Avdolyan himself, but by his proxies. A very convenient arrangement that allows you to avoid responsibility

Related news: "Rostech" vs. Bosov

Where did GMZ and YuEK themselves go, you ask? Everything here is quite simple: GMZ is still in the bankruptcy stage today, and UEC operates under the Almaz Energy banner, still remaining unprofitable: the loss in 2023 is 216 million rubles, in 2022 - 142 million rubles.

The most interesting thing is that Avdolyan said in 2022 that he sold his Stavropol assets and, they say, “the enterprise has been raised from the ruins and is not in danger.” But here’s the problem: Almaz Fertilizer’s loss for 2023 is 0.5 billion rubles, and it did not arise in one year. So this whole picture of the blissful recovery of the GMZ from the crisis is a fairy tale?

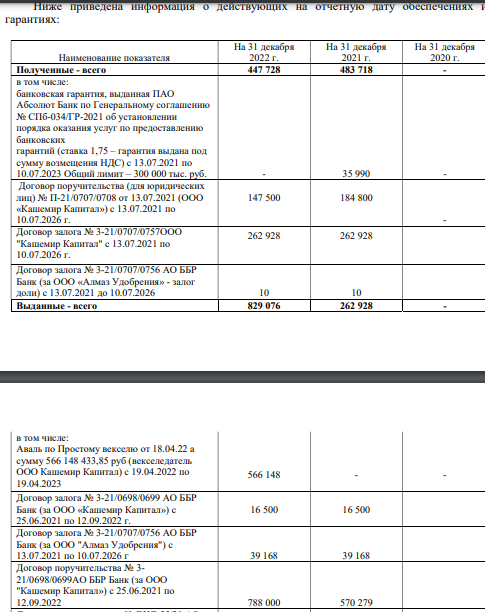

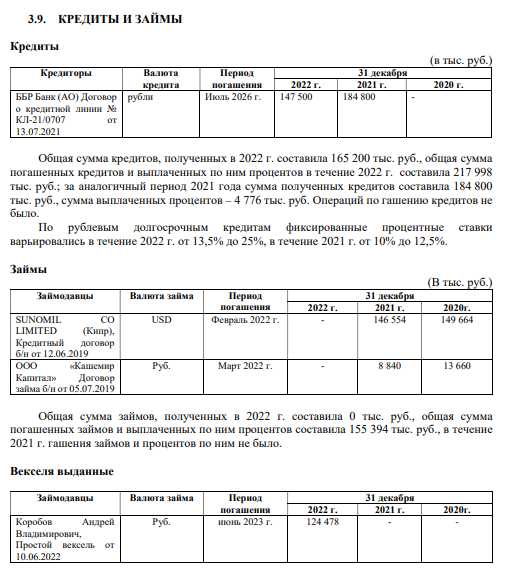

Moreover, BBR Bank, connected to Avdolyan through shareholder Gordovich, still has assets of Almaz Fertilizer in the amount of 605 million rubles pledged. And such debt load, to put it mildly, does not look like a rise from the ruins. More like a cobblestone tied to the “legs”.

Photo: bo.nalog.ru

BBR Bank previously appeared in a story about the withdrawal of 100 million rubles to the Latvian bank JSC Citadele Banka through offshore companies associated with Avdolyan. In addition, Gordovich himself, at the request of Avdolyan, was a member of the board of directors of Chelyabenergosbyt from the MRSEN division, representing a company associated with Osmanov. In this episode, as a result, 0.5 billion rubles disappeared into obscurity under the domestic lending scheme.

Judging by the reporting of Almaz Fertilizers LLC dated 2023, among its lenders was an offshore company already known to UtroNews readers - Sunomil Co Limited, associated with Avdolyan. He had previously been involved in a murky tax scheme involving another offshore company, with Fr. Caiman.

Photo: bo.nalog.ru

Photo: kad.arbitr.ru

Andrey Korobov, director of YATEK, whose beneficiary is again Avdolyan, also became a lender for Almaz Fertilizers LLC.

It seems that the oligarch sold the assets, but in fact left them under the credit of his squires.

It seems like this: liquid assets and capacities were taken from the problematic, but bought for pennies, GMZ and YuEK, new legal entities were created on their basis, showed some revenue and profit, and then they were merged with the new owners for other money. But the debts have not gone away, remaining on the old legal entities, and they have stuck to the new ones, but this, as they say, is not Avdolyan’s problem.

Moreover, the history of the bankruptcy of the ex-owner of GZM Makhov revealed an even more interesting picture of the manipulations of the oligarch Avdolyan.

2.5 billion story

The former owners of the plant at one time took out loans from Sberbank. On September 21, 2018, the bank ceded the right to claim debts to its subsidiary, SBK Plus LLC, and a couple of months later, it transferred it to a certain Almaz Capital LLC.

Then, in November 2018, bankruptcy proceedings were initiated against Makhov. During this case, in May 2019, the same Almaz Capital demanded that 2.5 billion rubles be included in the register of Makhov’s creditors, basing the claims on a guarantee agreement for the debts of GZM and YuEK.

At the first stage, the courts granted the request, but other creditors were not satisfied with this arrangement and they challenged the decision.

Higher authorities questioned the expediency of acquiring rights of claim against the debtor and the conscientiousness of it when going to court.

The judge clarified that the company’s acquisition of accounts payable to a de facto affiliated person may be an attempt to increase its controlled debt.

Photo: kad.arbitr.ru

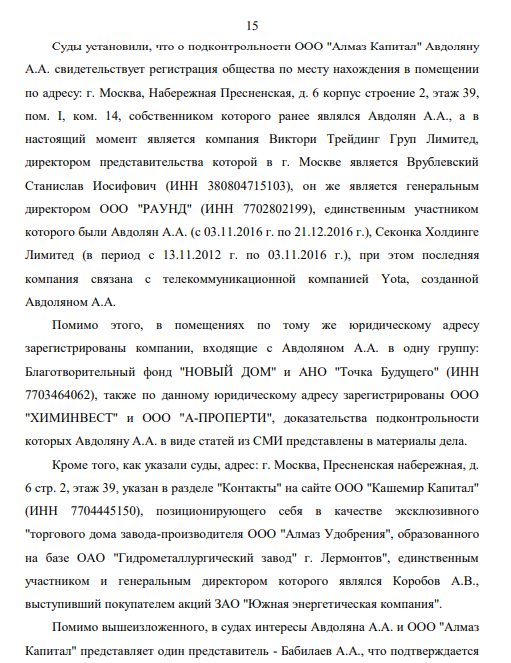

The court materials clarified that the main borrowers of the obligations - OJSC Hydrometallurgical Plant and CJSC Southern Energy Company, as well as the lender Almaz Capital LLC, which presented the claim, were part of the same group of persons, since they were controlled from a single center, which was the final beneficiary and the new shareholder of the enterprises Avdolyan A.A.

Photo: kad.arbitr.ru

The companies stopped paying their debts back in December 2017, but they began to demand their debts only a few years later.

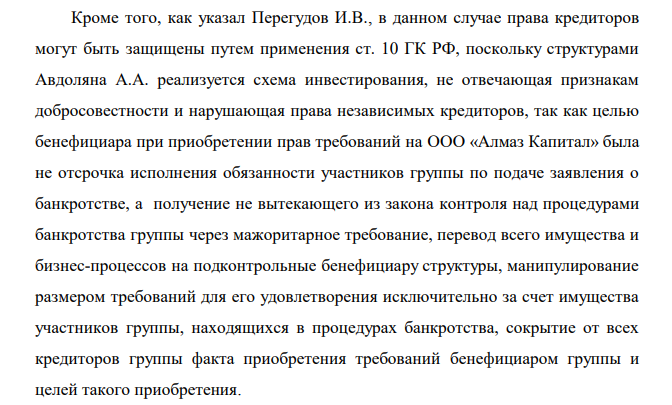

According to one of the creditors, Ilya Peregudov, Avdolyan A.A., controlling the creditor - Almaz Capital LLC and debtors, including the borrower, guarantor and pledger of Southern Energy Company CJSC, selectively makes demands, deliberately increasing current obligations. Moreover, according to the creditor, the purpose of acquiring rights could not be to repay debts on loans, but to transfer the business to A.A. Avdolyan controlled. persons

Photo: kad.arbitr.ru

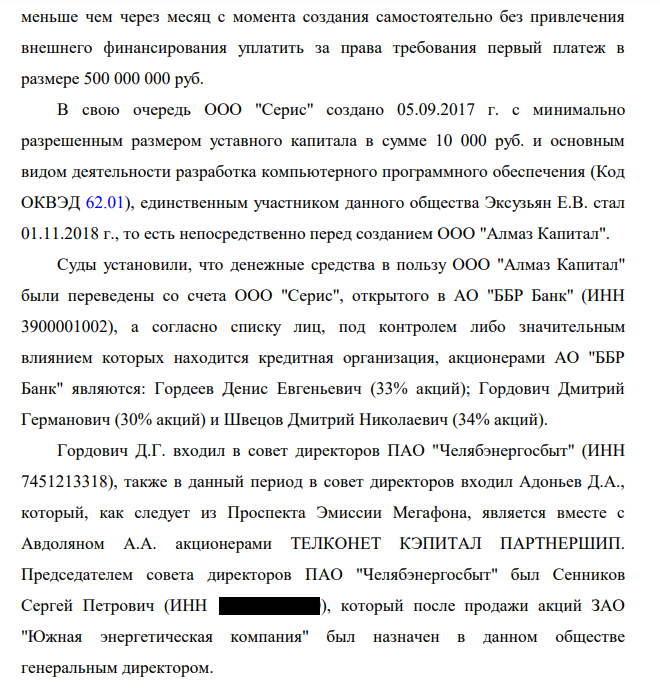

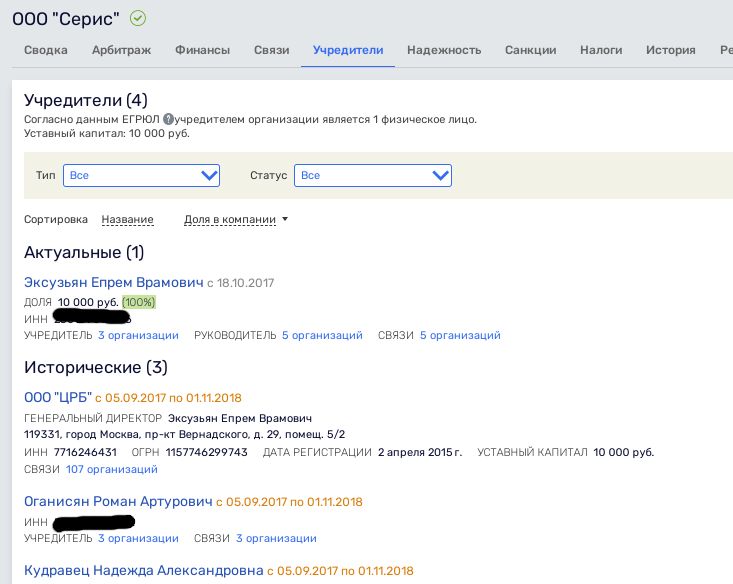

It also clarified that the creditor was created three weeks before the conclusion of assignment agreements with SBK Plus LLC with a minimum authorized authorized capital of 10 thousand rubles, and the origin of 0.5 billion rubles paid under the agreement was never established. It is known that the deal was financed by a certain SERIS LLC, and the money for the deal came from the accounts of the already well-known BBR Bank.

The owner of the newly created SERIS was E.V. Exuzyan, another acquaintance and director of Avdolyan’s companies, who at one time was also the director of Almaz Capital.

Photo: kad.arbitr.ru

Photo: kad.arbitr.ru

Nadezhda Kudravets, co-founder of Avdolyan’s “New House” fund, also featured in SERIS, and has also been involved in offshore schemes before.

Photo: rusprofile.ru

Moreover, Almaz Capital was registered in the premises, the owner of which was previously Avdolyan A.A., and then became the Cypriot Victory Trading Group Limited. The director of the latter’s representative office in Moscow was Stanislav Vrublevsky, the director of a number of Avdolyan’s companies.

Photo: kad.arbitr.ru

In our opinion, in the history of the GMZ another scheme was carried out with the participation of the oligarch’s proxies. The result was the transition under the wing of the latter plant and energy company, and at a low price.

It’s not for nothing that Chak and Makhov’s creditor, one of the founders of the Bartolius law office, Ilya Peregudov, tried to challenge the sale of the plant back in 2019. Questions also arose regarding the transaction price. Lenders valued the plant at 4–5 billion rubles, while the new owners got it for a nominal 7,600 rubles.

This is not the first time that questions have arisen for Avdolyan, but the powerful lobby in the person of Rostec and its permanent leader Sergei Chemezov, who go hand in hand the entire way of establishing the oligarch’s business, averts any troubles from him. Meanwhile, the competent authorities have long had something to ask the oligarch, who is overgrown with offshore companies and foreign money-boxes.